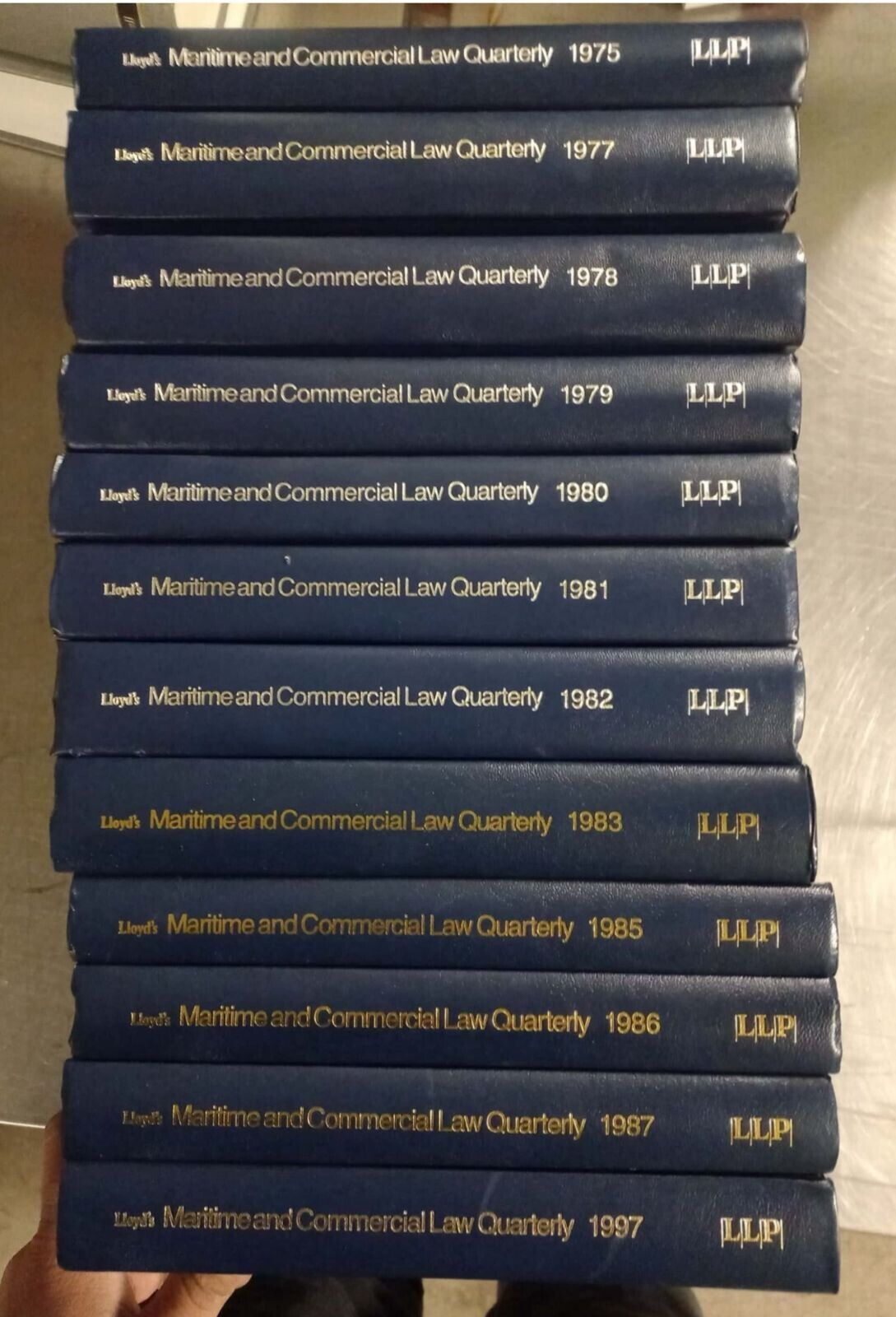

Description

This comprehensive encyclopedia on capital taxes offers an in-depth analysis of the relevant legal and economic principles. Written by a noted law book author, it is an indispensable resource for students and professionals working in the field of taxation. With a focus on clear and concise explanations, this textbook provides a thorough understanding of the subject matter without the need for prior knowledge or expertise. Whether you’re a student of tax law or a seasoned professional, this textbook is an invaluable tool for navigating the complexities of capital taxes. With its comprehensive coverage of the relevant legal and economic principles, you can be confident in your ability to understand and apply this information to real-life scenarios. Don’t miss out on this essential resource for anyone working in the field of taxation.